Subscribe

Stay in the know

Discover the latest payments news and events from Yaspa and the fintech world in our monthly newsletter.

The imperative for UK gambling operators to precisely understand and manage the Lifetime Value (LTV) of their players has intensified dramatically following the recent Autumn Budget changes, creating a financial reality where high tax burdens converge with hard regulatory limits on spending. The strategic shift necessitates treating LTV not just as a profitability metric, but as a crucial survival benchmark for operating within the UK. This urgency stems from a dual squeeze: severe profit compression caused by increased taxation and the enforced cap on potential customer value imposed by stricter consumer protection measures. Operators can no longer rely on a small number of high-spending accounts to deliver profitability; they must become hyper-efficient at maximising the long-term value of a broader, lower-spending customer base.How Intelligent Payments help protect LTV in a post-Budget environment

The most immediate pressure comes from the radical fiscal changes announced in the Autumn Budget of November 2025. The Remote Gaming Duty (RGD) is set to increase substantially from 21% to 40% starting 1 April 2026, while a new rate of General Betting Duty (GBD) for remote betting will rise to 25% (up from 15%) the following year. These tax increases are designed to raise an estimated £1.1 billion annually by 2029-2030, directly shrinking the Gross Gaming Revenue (GGR) that operators retain. Because the effective cost of the customer is now significantly higher due to the elevated tax rate, the traditional LTV of every customer automatically decreases. To maintain profitability, operators must demonstrate superior efficiency in retention, cross-selling, and low-cost acquisition methods, ensuring that the total revenue generated over the customer’s lifetime is sufficient to justify the now-higher operating costs that include the dramatic tax increase.

Simultaneously, the regulatory environment has imposed structural limits that directly cap the maximum potential LTV of high-value players. The Gambling Commission introduced mandatory stake limits for online slots, including a £5 per spin limit for players aged 25 and over, and a £2 limit for those aged 18 to 24. Furthermore, stringent affordability checks – which may require operators to request verified financial data to support Source of Funds (SoF) or spending habits – are now central to responsible gambling policy. These checks are known to impact LTV negatively by potentially causing high-value players to reduce their spending, leading to lower first-time deposits, or causing friction that results in player abandonment altogether. Therefore, successful LTV management is no longer about maximising individual high stakes, but about maximising the duration and depth of engagement across multiple product lines, while leveraging open banking tools to automate compliance checks, reduce customer friction, and prevent the costly loss of otherwise profitable customers during the mandated verification process.

In this constrained operating environment, payment infrastructure becomes a core financial lever rather than a back-office function. Intelligent Payments allow operators to both protect and extend player LTV by linking payments, affordability and compliance decisions in real time, using authorised open banking data.

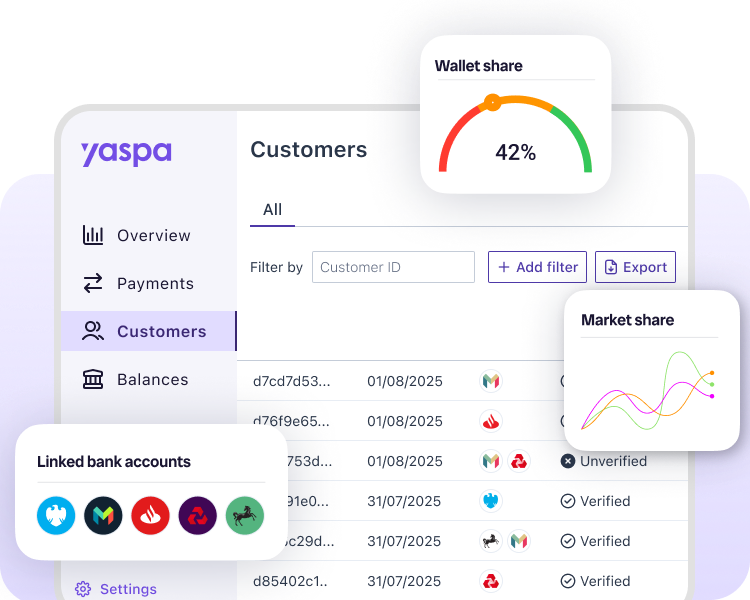

Yaspa’s Intelligent Payments combine instant payments with real-time affordability and identity insights, enabling operators to make informed decisions about who to retain, how to intervene, and where value can safely be extended. Rather than applying blunt risk rules or static thresholds that unnecessarily cap player potential, operators can segment customers based on actual financial resilience and behavioural signals.

From an operator’s perspective, this delivers three critical benefits.

Open banking data allows affordability checks to be automated and continuously refreshed, reducing the need for disruptive document requests that often cause player drop-off. Players with proven affordability can continue to transact with minimal friction, protecting LTV that would otherwise be lost through over-cautious restrictions or abandonment during manual reviews.

Intelligent Payments lower the total cost per customer by replacing card fees, failed transactions and chargebacks with instant, irrevocable bank payments. At the same time, automated financial checks reduce the operational burden on compliance teams, helping offset rising tax pressure by lowering servicing costs per active player.

By linking spend patterns directly to verified financial data, operators gain a clearer view of sustainable value rather than headline spend alone. This enables more accurate forecasting of true post-tax LTV, better capital allocation across acquisition and retention, and earlier identification of players whose value is deteriorating or becoming risky.

In a market where taxation compresses margins and regulation caps upside, Intelligent Payments shift the focus from chasing volume to protecting profitable, compliant longevity. For UK gambling operators, this is no longer a competitive advantage, but a financial necessity for sustaining growth under the new fiscal and regulatory reality.

For more information, visit Intelligent Payments or speak to one of our experts.

Subscribe

Discover the latest payments news and events from Yaspa and the fintech world in our monthly newsletter.

"*" indicates required fields