Subscribe

Stay in the know

Discover the latest payments news and events from Yaspa and the fintech world in our monthly newsletter.

The advent of the internet changed how we work, shop, and socialise. So many of the activities we do online were unthinkable just 20 years ago. In fact, many were considered science fiction. Today, something similar is happening with the metaverse.

For most people, the metaverse is a futuristic concept that is difficult to grasp. However, for many (albeit a niche segment) this new virtual realm already represents a significant component of their lives – and a market opportunity expected to reach USD 800 billion by 2024 (Vanguard, 2022).

In short, the metaverse is a new virtual world combining virtual reality, AI and other technologies. A person participates in the metaverse via an avatar. All kinds of activities can be carried out through this digital entity, from playing and studying to working and shopping. And this presents a unique technological challenge. It is essential to equip the virtual environment with tools offering people ways to pay for goods and services in an undisrupted way, preserving the immersive nature of the experience.

Non-Fungible Tokens (NFTs) are fast becoming tangible, with online users relating them to existing brands and goods.

An excellent example is Nikeland, the virtual alternative to Nike stores housed inside Roblox (an online gaming platform that allows users to create games and play games created by other users). If you doubt the economic impact these interactive marketplaces can have, consider that in 2021 alone, Nikeland saw $3 million in sales in less than an hour.

Many brands are already exploring ways to use digital and virtual experiences to increase their physical sales. Retailers must be prepared to take advantage of these new opportunities to remain competitive.

Virtual shops could act as laboratories for companies and their customers. Brands could test new ideas before producing them and bringing them to market in the real world.

Likewise, shoppers could interact with a product digitally before purchasing it in real life. People could try on the virtual item, creating new combinations and making changes to their looks before buying the physical version. They could even make a double purchase, buying the physical and virtual product—the latter for their avatar.

Commercial transactions in the metaverse pose significant challenges for payment providers. Many of these transactions involve small and often repeat transactions, known as micropayments. Commercial activities like in-app purchases and the acquisition of NFTs and tokens can cost less than a dollar or, in some cases, even fractions of a cent.

However, the high costs of transaction fees associated with traditional payment services, such as credit or debit cards, bank transfers or PayPal, can be a disincentive (charging up to 6% per transaction) for eCommerce merchants dealing with such small numbers.

Merchants must also consider digital currencies, which increasingly have value inside and outside of the metaverse. One reason for their growing popularity is their ability to meet users’ demands for more secure, frictionless payment methods, which blockchain payments provide. Lower transaction costs associated with e-wallets make digital currencies ideal for micropayments, including non-traditional exchanges, such as donations to digital creators.

Only a few retailers currently include digital currencies in their payment methods. But as their popularity and use grow, companies (including those in the financial sector) will be forced to embrace them.

So, what can merchants do to adapt to this burgeoning payment landscape to ensure they maximise the benefits and are not left behind? Here are four steps merchants can take to adapt to the new digital payments environment and achieve sales success.

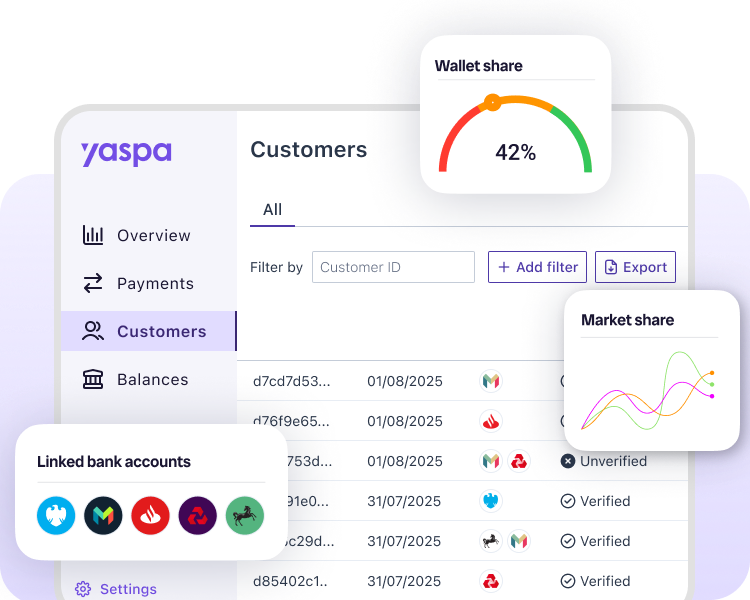

Yaspa offers online merchants payment solutions that allow them to adapt their checkout to a new digital eCommerce environment with ease.

By choosing to use open banking technology, your customers can make cardless payments directly from the bank account of their choice without entering codes, pins or impossible-to-remember card numbers. Perfect for keeping immersive shopping experiences disruption-free!

In addition, paying in and out with Yaspa cuts out intermediaries, eliminating high transaction fees, meaning you’ll get to keep more of your bottom line. And did we mention our payments settle 36 times faster than cards?

See for yourself how Yaspa is transforming the way we pay now and in the future – try a payment here. For a full demo or to talk to us about adding Yaspa to your checkout, contact our team.

Subscribe

Discover the latest payments news and events from Yaspa and the fintech world in our monthly newsletter.

"*" indicates required fields