Subscribe

Stay in the know

Discover the latest payments news and events from Yaspa and the fintech world in our monthly newsletter.

The recent announcement by the UK’s Financial Conduct Authority (FCA) of its intention to expand Variable Recurring Payments (VRPs) into commercial use cases has sparked industry-wide discussion. This open banking innovation offers the potential for seamless, one-click transactions, subscriptions, and transformative advancements in payments, positioning VRPs as a true competitor to contactless card payments and direct debits.

However, these opportunities come with risks that must be carefully managed. At Yaspa, we believe the key to success lies in balancing innovation with unwavering consumer protection. In this post, we explore what the FCA’s move means, and how businesses can unlock VRP’s potential while avoiding past pitfalls.

The FCA’s latest update outlines critical steps to further implement VRPs. This includes promoting their use beyond the initial scope of ‘sweeping’ (transfers between a user’s own accounts) into commercial applications. VRPs are presented as an evolution from traditional payment methods such as direct debits and card-on-file, offering a faster, more secure, and user-friendly alternative.

A key takeaway from the announcement is the call for collaboration across the payments ecosystem. Both the FCA and the Payment Systems Regulator (PSR) emphasise the need for clear communication, transparency, and trust-building to ensure widespread adoption of VRPs.

For further reading, see the FCA’s official statement on VRPs and the PSR’s stance on open banking.

VRPs allow customers to pre-authorise variable recurring payments (e.g. up to £200/month) via open banking. Unlike direct debits or card-on-file systems, they offer dynamic consent: users approve payment ranges, not fixed amounts. For businesses, VRPs could enable scenarios such as:

However, as we’ve previously explored, VRP’s untapped potential hinges on addressing its blind spots.

With the rise of payment providers such as Klarna and Clearpay, the ‘Buy Now, Pay Later’ (BNPL) boom offers a cautionary tale: frictionless payments often mask financial harm. By decoupling purchases from immediate consequences, BNPL normalised debt for everyday spending and may even have become a reputational risk for ethical brands.

Without appropriate safeguards, VRPs could contribute to the same financial pitfalls seen in BNPL models. For example:

The lesson? A lack of safeguards surrounding innovation leads to a breakdown of trust and attracts unwanted regulatory attention.

A responsible path forward: data as the differentiator

At Yaspa, we’ve learned that payment innovation must prioritise consumer outcomes. Here’s how businesses can approach VRPs responsibly:

1. Dynamic consent powered by AI

2. Transparent user controls

3. Proactive risk mitigation

As we’ve discussed, VRP’s success depends on answering tough questions early — not retrofitting safeguards.

The FCA’s announcement isn’t just about faster payments – it’s a call to redefine responsible innovation. For various industries, this means leveraging VRP’s flexibility while embedding accountability at every step. By prioritising data-driven guardrails and transparency, businesses can avoid becoming the next cautionary tale and instead lead a new era of ethical payments.

At Yaspa, we’re committed to helping industry leaders navigate this shift responsibly – because the true cost of payment innovation isn’t measured in fees but in customer harm avoided.

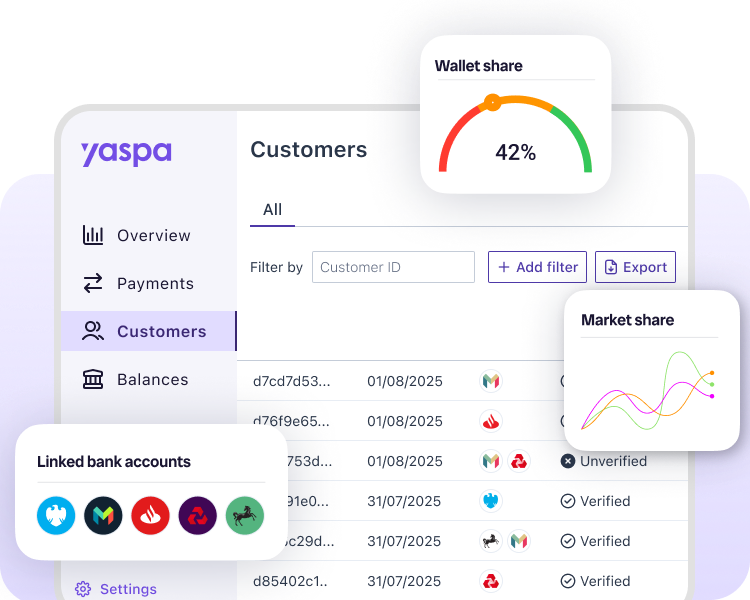

While we await further regulatory clarity, Yaspa is leveraging our core strengths – real-time analytics and compliance-grade open banking infrastructure – to help businesses lay the groundwork:

Want to stay ahead of the curve?

Explore our insights on VRP’s untapped potential and answers to key questions shaping this technology.

Interested in building a safer payment strategy?

Contact Yaspa to explore how our instant payment solutions can future-proof your business today.

Subscribe

Discover the latest payments news and events from Yaspa and the fintech world in our monthly newsletter.

"*" indicates required fields