Subscribe

Stay in the know

Discover the latest payments news and events from Yaspa and the fintech world in our monthly newsletter.

This article explores the untapped potential of Variable Recurring Payments (VRPs), and the regulatory issues governing their roll out in the UK today. If you’re new to VRPs, start with our beginners’ guide to Variable Recurring Payments.

The successful initial adoption of Single Immediate Payments (SIPs), which occurs when a payer authenticates a one-time transaction via open banking, has proven that there is an active market in the UK for this type of alternative payment method. There are currently over 11 million people actively using open banking services, and throughout 2022 68.2 million open banking payments were made in the UK (reaching a month-on-month growth of 10%).

However, there are several repeat payment use cases that cannot be served by SIPs, such as paying for a monthly subscription or regular bills, or providing pre-authorisation at the petrol pump. These instances, or any payment scenario that requires a consumer to put a card on file or use a direct debit, could be replaced by open banking-enabled VRPs. This form of alternative payment method has already demonstrated major growth, and as of July 2023 872,000 VRP transactions were recorded, representing a 28.7% increase on the previous month.

VRPs currently take two forms, sweeping and commercial. Sweeping is the automated movement of a customer’s funds between personal bank accounts registered in their name, such as a current and savings account. This has been mandated by the Competition Market Authority (CMA) and is a service offered to customers of the UK’s nine largest banks (known as the CMA9).

Unlike sweeping VRPs, commercial VRPs enable customers to make regular payments from their personal account into a merchant’s or a business’ account, and are not mandated by the CMA. As a result, the implementation of this form of VRP has been slow due to little optional take-up from UK banks. As of writing, there simply isn’t enough nationwide availability of VRPs to enable the whole of the UK consumer market to benefit from this type of automated account-to-account (A2A) payment provision between personal and business accounts.

VRPs are hailed for being a more seamless and transparent alternative to Direct Debits because they offer ongoing permission to take payments within an agreed value, and consumers can see a list of who they’ve agreed to pay and how much all in one place, unlike cards. Consumers have more control with VRPs as agreed payment amounts cannot be altered, whereas they can with Direct Debits, meaning future payment amounts can vary as they’re not capped.

In order to unlock the potential of VRPs in the UK, there are several challenges facing account providers (such as banks), Third Party Providers (TPPs) like Yaspa, and merchants looking to adopt this kind of payment functionality. These hurdles include:

NatWest Group began their pilot of commercial VRPs back in the first half of 2022. There was much expectation and enthusiasm that this would provide the catalyst for more account providers, like banks, to enable commercial VRPs for their customers (who include UK consumers and merchants). However, the lack of a mandate from the CMA has slowed other account providers from investing in enabling this offering.

Another reason for this slow adoption has also stemmed from concerns surrounding payment liability and achieving a level of standardisation and fairness across TPPs and account providers over access to data. Account providers have the right to charge TPPs for the provision of data required for commercial VRPs, such as a person’s age, but due to the lack of a regulatory order mandated by the CMA the amount that is charged is inconsistent between account providers.

There are two concerns here. The first is related to competitiveness: a larger TPP capable of processing higher volumes of payments may come to a cheaper agreement with a bank compared to its more modest counterpart. Concern number two stems from the premium nature of the VRPs as a service – which offers the most convenient way to make regular payments. As a result, banks or account providers may charge TPPs (and merchants by-proxy) high transaction fees for VRPs, making them prohibitively more expensive than cards and slower to adopt.

Still, NatWest Group has created the foundations for enabling commercial agreements to be reached with TPPs over the provision of commercial VRPs, and this could pave the way towards a framework for other account providers looking to invest in and enable this functionality for their customers.

In addition, the Joint Regulatory Oversight Committee (JROC), which has been tasked with outlining the future of the UK open banking market, published their framework on ‘Principles for commercial frameworks for premium APIs’ in June 2023. This sets out how banks and account providers should look to set commercial arrangements with TPPs, and includes guidance on drawing-up commercial contracts with TPPs on the provision of commercial VRPs.

Customer protection has long been an issue hindering the adoption of A2A payments, like those powered by open banking, in the UK market. Debit cards and credit cards offer some customer protection in the form of chargebacks and Section 75, enabling customers to make a claim and have funds returned to them if an issue with the goods or services has occurred. Account providers then typically investigate the claim by asking for evidence, before taking a decision to reimburse the customer.

However, while users of open banking payments can’t make these types of claims, they are protected by broader regulation when making purchases, such as the Consumer Rights Act, enabling customers to dispute issues with unsatisfactory goods and services they have paid for. For businesses, the lack of a claims procedure removes the headache of processing indemnity claims associated with Direct Debit (which are often complicated), helping to streamline payment processes.

When it comes to consumer protection concerning regular payments, commercial VRPs are most similar to Direct Debits.. The latter relies on banks and building societies to provide the Direct Debit Guarantee to protect customers for payment issues (e.g. if the payment is taken on the wrong date, or the amount collected is incorrect). The guarantee does, however, fall short of offering protection for contractual disputes between the consumer and merchant.

A clearer protection framework for customers, merchants and account providers will encourage more investment across the industry in commercial VRPs. A clearly defined liability model will not only provide more security, it will reassure all concerned parties that there is a fair and effective dispute process when purchasing goods and services, and if payment issues occur.

A lack of regulatory guidance on the implementation of commercial VRPs opens the market to inconsistencies. Some TPPs may get preferential treatment in their commercial agreements with account providers, and as a result, the controls designed to support a consumer when setting-up a VRP, such as managing their consent, may differ. For example, larger businesses may benefit from being able to agree non-limited consents with TPPs and account providers. This means that, while a consumer benefits from a smooth one-click payment experience, their ability to control their purchase behaviour with that merchant is diminished. The implementation of commercial VRPs should, out of principle, treat customers fairly by remaining consistent across TPPs and account providers.

Several names have been mooted for this type of repeat payment method, including Non-Sweeping, Discretionary VRP and Commercial VRP, adding to the inconsistencies surrounding VRPs. Of these terms, none are consumer-facing or feel familiar, nor do they adequately differentiate between CMA-mandated sweeping and its commercial counterpart.

The consistent implementation of commercial VRPs for both TPPs and account providers, as well as a customer-centric naming convention, will be key to strengthening consumer understanding and demand for this type of payment method.

In June 2023 the Joint Regulatory Oversight Committee (JROC) outlined the next steps for open banking in the UK. Their roadmap included refocused efforts on the roll-out of VRPs with attention paid to the CMA mandating commercial VRPs to achieve greater fairness around how account providers charge TPPs and merchants to use this service. In the months since, a VRP working group has been tasked with producing a strategy for the implementation of commercial VRPs across UK banks and account providers by the end of September 2023. This will then be reported back to the JROC who will publish its views in an update towards the end of 2023.

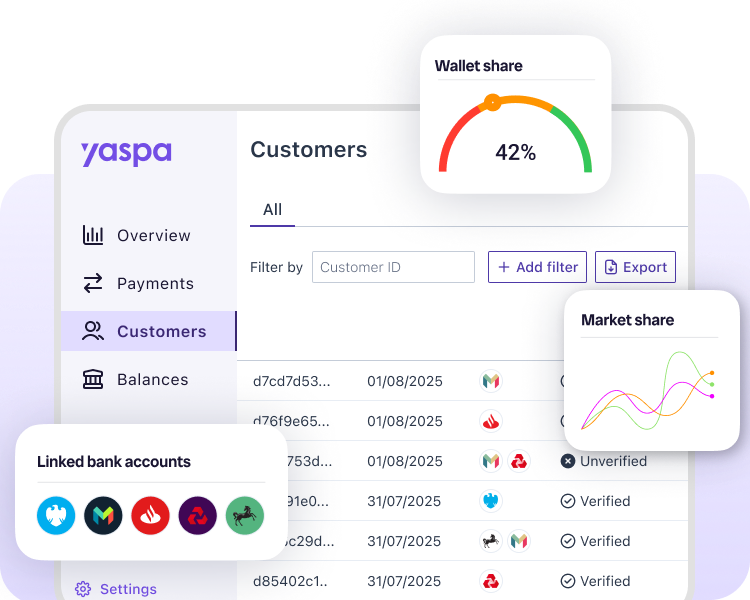

Whilst the implementation of commercial VRPs among account providers has been slow, Yaspa welcomes the ongoing review by JROC. It is encouraging that the forthcoming blueprint will set out a more structured approach to tackling the challenges identified and will, hopefully, facilitate a successful roll out across the UK. As a TPP providing A2A payments that are optimised to simplify the way people pay, commercial VRPs are a core part of our strategy and roadmap at Yaspa. If you’re interested in how we can improve your payment processes using open banking, get in contact. We’re always happy to help!

To learn more about the different types of A2A payments, how they compare to cards, and their benefits to businesses and consumers alike, grab yourself a coffee and read our quick guide on account-to-account payments using open banking.

Subscribe

Discover the latest payments news and events from Yaspa and the fintech world in our monthly newsletter.

"*" indicates required fields