Opinion: Visa exits US open banking – despite America’s continued banking boom

News recently broke that Visa is halting its open banking operations in the United States. As Head of Product at Yaspa, I’ve been closely following this development and what it means for the industry. Visa’s decision appears to be a strategic retreat in the face of a crowded and challenging US data connectivity landscape, already populated by established players like Plaid, Finicity (acquired by Mastercard in 2020 for $825 million), MX, and Akoya. Building a competitive data pipeline from scratch would have required massive investment, or else Visa would have had to acquire another aggregator at great cost. (In fact, Visa did attempt to buy Plaid for $5.3 billion in 2020, before the Department of Justice raised antitrust concerns and the deal was terminated.) Instead, Visa pivoted to Europe by acquiring Swedish open banking platform Tink for about $2.2 billion in 2021, signaling that Visa chose to double down where it saw a more accessible opportunity.

In my opinion, Visa’s withdrawal isn’t due to a lack of opportunity in the US; rather, it reflects an internal strategic decision about where to allocate resources most effectively. The official line is that ‘regulatory uncertainty’ and brewing battles over data access fees played a big role in Visa’s exit. Visa’s US open banking unit had offered fintechs tools to connect with bank accounts (for seamless onboarding and money transfers), but tensions between banks and fintechs over customer data access have escalated.

Major banks like JPMorgan Chase signaled they may start charging hefty fees for third parties to access their customers’ data. Banks argue these fees would cover security and infrastructure costs, while fintechs counter that the data belongs to consumers and fees would stifle innovation. This standoff, combined with regulatory whiplash (the Consumer Financial Protection Bureau’s data-sharing rule was finalized in late 2024, only to face potential rollback under a new administration), created an ambiguous environment. From Visa’s perspective, the U.S. open banking sector may have looked like an uphill battle with uncertain near-term ROI, whereas regions like Europe and Latin America appeared more straightforward with pro-open-banking regulations. In Visa’s own words, they are now ‘focusing [their] open banking strategy in high-potential markets like Europe and Latin America’.

However, as someone deeply ingrained in this industry, my take is that Visa’s exit is not a verdict on US open banking’s potential – far from it. Rather, it underscores that Visa had its hands full elsewhere (integrating Tink and pushing new initiatives in Europe), and it wasn’t ready to pour the required investment into the US, at this time. I suspect Visa needs to see returns from its European open banking bet (Tink) and its new Visa A2A scheme before committing further in the States.

America: the world’s largest open banking market is growing

Despite recent regulatory seesaws,the United States is now arguably the largest open banking market in the world by user numbers. Even without a formal mandate until now, open banking in the US has thrived through market-driven adoption. The Consumer Financial Protection Bureau (CFPB) estimates that at least 100 million Americans, roughly 1 in 3 adults, have already authorized a fintech app or third party to connect to their bank account and access their financial data. This means over 100 million US consumers are using open banking services, whether that’s linking bank accounts to budgeting apps, funding digital wallets, or paying via bank transfer on new platforms. By sheer scale of users, the US leads the global pack. This massive user base is more than the entire population of many countries, highlighting that Open Banking / Open Finance in the US is mainstream, even if not recognized globally by the broader Open Finance Industry.

From a revenue standpoint, the US open banking market size is keeping pace with, and set to overtake, other regions. In 2024, US open banking revenues were estimated around $7.1 billion, second only to Europe’s $11.5 billion that year. But projections show the US growing faster: by 2030 the US open banking market is forecast to reach about $31 billion, outstripping any other single country and making the US the largest single-country market by revenue. In fact, the US is expected to account for the biggest share of global open banking revenues by the end of the decade. The growth rate is impressive, roughly 27.9% CAGR from 2025 through 2030, reflecting strong momentum. In short, the US is an open banking powerhouse in the making, not a laggard.

So why is US open banking booming, even as a voluntary, market-led ecosystem? In short, open banking has already found product market fit across the world, and there continues to be consumer demand for convenience and innovation. American consumers have embraced fintech services in droves: one in three US bank customers has used Plaid to connect their account to an app, and roughly 4 in 5 Americans use some form of fintech tool in their financial lives. This consumer pull has driven banks and fintechs to collaborate (sometimes uneasily) to enable data sharing and account connectivity. Now, with the CFPB’s still-alive Personal Financial Data Rights rule – mandating banks let customers share their data with third parties – going into effect, the US is moving toward a more structured open banking regime. The CFPB is now moving quickly to shape and formalize this initial ruling, particularly in light of JPMorgan’s proposal to introduce fees for data access. Taken together, these steps will create more certainty in the market, underpinned by regulation. It’s an exciting prospect: a market this large, with a clearer rulebook, will spur new products in personal finance, payments, lending, and beyond.

One promising area for new products is digital identity verification and onboarding. In the United States, banks already allow third-party platforms to access verified customer details, such as addresses, phone numbers, and emails, via secure APIs. This capability lets fintechs auto-fill forms with bank-verified data during sign-up, ensuring a customer’s identity matches their bank account and thus reducing onboarding friction and fraud risk. For example, identifying mismatches between user-supplied KYC information with their bank-verified data can flag fraudulent actors engaging in activities such as account takeover, AML and prevent account-to-account payment scams before they happen.

By contrast, UK and European frameworks have been slower to commercialize bank-verified identity data. Open banking technically supports sharing certain identity attributes – indeed, providers like OneID in the UK use bank-verified data to instantly confirm names, addresses or ages for KYC checks. However, beyond the basic account data access mandated by PSD2 (and anticipated in PSD3’s open finance proposals), banks have made little progress in turning identity attributes into widely available services. Many major UK banks acknowledge the potential in offering verified identity info, yet they’ve been hesitant to deliver it through open banking channels. Their caution stems from parallel digital ID initiatives and concerns over data accuracy (since some bank-held personal details can be outdated). Overcoming these hurdles and leveraging bank-verified identity at scale could unlock safer onboarding and better fraud protection across financial services, on both sides of the Atlantic.

Visa’s focus in Europe – and what it means

Visa’s pivot to Europe can be seen in the context of where it sees immediate opportunity. Europe’s open banking environment, driven by legislation like PSD2, forthcoming PSD3 and the introduction of the EU SCT Rule Book, requires banks to provide free access to account data for licensed third parties. This regulatory head-start means a more standardized playground (at least in theory) for companies like Visa to build upon. Visa’s acquisition of Tink, a European platform connecting to over 3,400 banks, was a clear play to own the connectivity rails across Europe. However, building a profitable business out of data connectivity is a long game. To date, it’s unclear if Visa has made any big revenue gains from Tink; indeed, it’s telling that we haven’t seen public reporting on Tink’s post-acquisition revenue, suggesting the European open banking venture is still maturing in Visa’s portfolio.

Where Visa has been vocal is in pushing the next evolution of open banking payments in Europe. Specifically, Visa is championing Commercial VRP (Variable Recurring Payments) via a program called Visa A2A (account-to-account). This initiative aims to create an open banking payments scheme with the kind of dispute resolution, liability rules, and consumer protections that card networks offer. Essentially, Visa wants to make ‘Pay by Bank’ transfers as ubiquitous and trusted as card payments by layering on standards and guarantees.

However, Visa’s A2A gambit hasn’t been without controversy. Many in the fintech community have greeted it with skepticism, seeing it as Visa importing a card scheme mentality into consumer-led open banking. An industry built on the promise of lower fees and direct connectivity is naturally wary of a heavyweight potentially imposing new commercial models or fees. Moreover, in the UK, the industry has been working toward its own future governance model for open banking – the recently announced ‘Future Entity.’ This new entity (a not-for-profit organisation) will set standards for UK open banking APIs, monitor performance, and coordinate the ecosystem’s next steps (like commercial VRP and even Open Finance). Crucially, the Future Entity will not have regulatory enforcement powers; it relies on voluntary cooperation among banks and fintechs. This could slow progress on innovations like commercial VRP or data-sharing for identity. If banks aren’t compelled, we may see the same inertia of the past three years. In that context, Visa’s attempt to jump-start commercial VRP via A2A can be seen as both a bold move and a source of friction. Will the industry rally around a Visa-led scheme, or wait for the broader ecosystem consensus via the Future Entity? The jury is still out. What is clear is that Visa has its hands full navigating these developments in Europe.

Opportunity knocks for US businesses and fintechs

For U.S. businesses, from iGaming operators to e-commerce merchants and beyond, the takeaway from Visa’s withdrawal is not ‘open banking is risky,’ but rather ‘open banking is wide open’. The US market’s very size and momentum mean that innovation will continue, perhaps even faster now, as independent players step up to fill any gap Visa leaves. Open banking payments (often branded ‘Pay by Bank’) represent one of the most exciting opportunities on the horizon. In the UK and Europe, we’ve become quite accustomed to consumers paying merchants directly from their bank account, authenticated in real-time, without card networks in the middle. It’s faster (instant settlement), more secure (bank-grade authentication, no card numbers to steal), and can be lower-cost (fewer intermediaries).

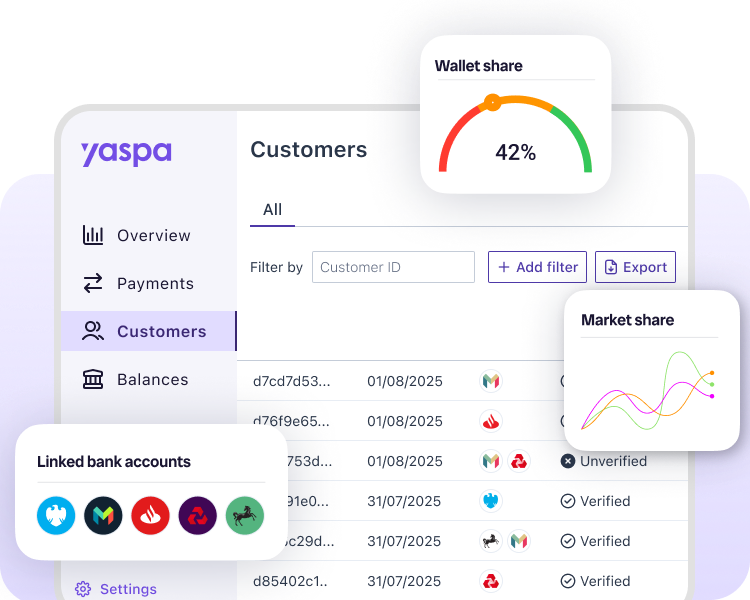

Imagine a sportsbook or online casino in the US where players can deposit funds directly from their bank account with nearly 100% success. To that end, I am excited to be leading Yaspa’s US launch to offer our Intelligent payments platform offering Guaranteed ACH – a mechanism that ensures bank-to-bank deposits are accepted at extremely high rates. This Pay by Bank approach taps into the massive US ACH network (which processed over 40 billion transactions in 2024) while mitigating the usual risks of ACH. By performing real-time account checks to confirm sufficient funds and advanced risk analysis on each transaction, the system can guarantee payment to the operator, eliminating failed payments and unauthorized returns for merchants. The result is vastly improved deposit acceptance. Crucially, the user experience is seamless – in the US, a single account consent is all that’s required to initiate an ACH payment. Players link their bank account once and can then make instant deposits with a simple confirmation for each return visit. This one-click flow for returning users drives significantly higher conversion and loyalty, all while reducing friction at the cashier. At the same time, it helps maintain security by analysing potential risks on each ACH payment.

But for Yaspa, the benefits go well beyond payment success. With players’ consent, our solution leverages real-time financial data from their bank accounts to enable smarter retention and player management across the entire lifecycle. Our AI-assisted Intelligent Payments platform analyses account activity, at the point of deposit, to deliver instant actionable insights – for example, assessing whether a transaction is genuinely affordable for the player and flagging early signs of financial harm. In practice, operators receive timely alerts when a player’s spending patterns deviate from the norm, allowing them to take proactive action. This could mean catching suspicious activity that hints at fraud or identifying emerging patterns that raise responsible gambling concerns (2.5 million Americans have severe gambling problems, according to the National Council on Problem Gambling) so they can offer support. These integrated safeguards not only protect players but also enhance trust and long-term engagement. With up-to-date insight into a player’s financial health, operators can personalize their retention strategies (such as tailored promotions, spending reminders, or adjusted deposit limits) to keep players satisfied and safe. In short, US gambling operators and Yaspa have an opportunity to offer a seamless, secure bank-payment experience that maximizes payment acceptance and harnesses AI-driven financial intelligence to boost user satisfaction and retention – all with minimal friction.

Looking ahead: open banking’s next chapter in the U.S.

Visa’s decision to retrench from US open banking might have made headlines, but the underlying story is one of continued growth and innovation. The United States now finds itself in an enviable position: a massive user base that has embraced fintech connectivity, and a forthcoming regulatory framework that can solidify standards and rights across the US’s large network of Financial Institutions. As that framework (Section 1033 rulemaking) rolls out in phases over the next few years, we can expect even more investment and product development in this space from banks, fintechs, and yes, perhaps even new consortia or alliances stepping in where Visa left off. The competitive landscape may be crowded, but that competition breeds better solutions and choices for consumers and merchants.

In my opinion, Visa’s absence will scarcely be felt by end-users. The plumbing for open banking is already in place through providers like Plaid, Finicity, MX, Fiserv and Akoya. What it does create is an opportunity for innovators. Fintechs can now build on this foundation, using secure data access and payments connectivity to deliver unique products and services that drive real consumer adoption of open banking. The US market has already shown the power of the consumer – over 114 million people are willing to connect their bank accounts to apps and services they trust. The next wave of growth will come from those who take this existing infrastructure and reimagine what’s possible: faster payments, smarter onboarding, richer insights, and ultimately better financial experiences for users. For Yaspa, that’s exactly where our focus lies – helping operators and merchants unlock the full potential of open banking in the US, while continuing to drive innovation across our existing markets.

Yaspa is looking forward to connecting with the industry and will be in attendance at the following events in the US in 2025:

G2E – Las Vegas 6 – 9 October 2025

Money 20/20 USA – Las Vegas 26 – 29 October 2025

Gaming Leaders’ Summit – Miami 17 – 15 November 2025

Get in touch to book a meeting to find out how Yaspa can help you modernize and streamline your payments.