Subscribe

Stay in the know

Discover the latest payments news and events from Yaspa and the fintech world in our monthly newsletter.

Instant payment networks, such as the UK’s Faster Payments Service (FPS) and the Single Euro Payments Area (SEPA) Instant Credit Transfer (SCT Inst), have transformed the financial landscape, enabling real-time, 24/7 money transfers. These networks offer unparalleled speed, convenience, and security compared to traditional methods, benefiting both consumers and businesses.

Instant payment networks operate on specific payment rails, which are the underlying infrastructure and protocols that facilitate the transfer of funds. In the UK, FPS uses the New Payments Architecture (NPA), while SCT Inst relies on the SEPA Instant Credit Transfer scheme. These rails enable the rapid and secure movement of money between accounts, bypassing traditional intermediaries and lengthy processing times.

Here’s a step-by-step explanation of how these networks function:

This entire process typically takes just a few seconds, allowing for near-instant transfer of funds between accounts.

The UK’s FPS, launched in 2008, processes over 4.5 billion payments annually, with a total value of £3.7 trillion. Similarly, Europe’s SCT Inst, introduced in 2017, facilitates instant, cross-border euro payments within the 36-country SEPA zone. These networks have driven innovation in financial services, increased financial inclusion, and improved cash flow management for businesses.

The COVID-19 pandemic also dramatically accelerated the adoption of digital payments, further emphasising the importance of instant payment networks. In one Experian report, ‘Open banking demand triples during Covid-19 pandemic’, they found that ‘57% of lenders have adopted open banking technology in the last 12 months’. This can be seen as part of a broader trend, with all forms of contactless payments benefiting from a situation which encouraged low-contact environments.

Moreover, this trend didn’t go unnoticed by prominent VCs, with investment in contactless payments further driving growth.

Open banking has significantly impacted the payments landscape, giving merchants access to the fastest payment rails previously reserved for banks. This benefits merchants in several ways:

The speed of payments depends on the underlying payment rails. Card payments can take up to 3 days to settle, while digital wallets like PayPal are typically faster. Direct debit payments are comparatively slow, as the merchant pulls the money from the customer under a pre-agreed mandate.

In the UK, bank-to-bank payments through FPS typically settle instantly, with recipients receiving funds within seconds or up to 2 hours in some cases. In Europe, the picture is more complex due to the optional nature of SCT Inst and varying levels of coverage across countries. However, in a recent announcement in February 2024, the European Parliament unveiled a new regulation aimed at streamlining instant payments throughout the European Union. Under this new framework, all financial transactions conducted within the Eurozone will be processed in less than 10 seconds, thanks to the standardisation of real-time payment infrastructures across the region.

Michiel Hoogeveen (ECR, NL) the lead MEP said: “The Instant Payments Regulation marks the long-awaited modernisation of payments in the European single market. Customers can now say goodbye to the inconvenience of waiting two or three working days to access their money. We are delivering on something that people and businesses truly care about: transferring money within 10 seconds at any time of the day.”

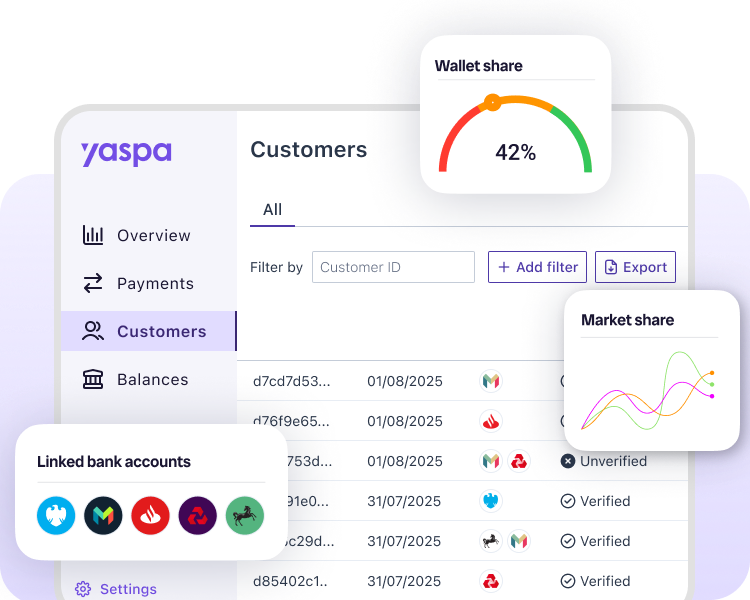

Open banking payments, processed through providers like Yaspa, allow merchants to benefit from these fast rails without the need for regulation or unsafe practices like screen-scraping. As open banking payment volumes grow, more banks are incentivised to join faster payment schemes, ultimately benefiting customers with consistently instant payments.

The rise of instant payment networks and the impact of open banking have revolutionised the way we conduct financial transactions. As these technologies continue to evolve and gain adoption, they will play a crucial role in driving innovation, promoting financial inclusion, and enabling a more efficient global economy.

Yaspa provides instant bank payments and account verification, using open banking technology. If you’re interested in learning more about what Yaspa can do for you, get in touch. We would love to hear from you.

Subscribe

Discover the latest payments news and events from Yaspa and the fintech world in our monthly newsletter.

"*" indicates required fields