Subscribe

Stay in the know

Discover the latest payments news and events from Yaspa and the fintech world in our monthly newsletter.

Payments are a vital part of our everyday lives. Partly as a result of the pandemic, but also due to longer-term societal and technological changes, the way we all pay is currently undergoing enormous shifts: increasingly contactless, cashless and online, we need our payments to be smooth and secure. We expect transactions to happen instantaneously, our retailers to trust us if we’re regular customers, and to accept our payment method of choice (and that includes crypto…)

In the UK it has become clear that the current payment systems are not up to scratch. So we’re delighted to introduce the industry’s solution: a New Payments Architecture.

The New Payments Architecture (NPA) is a complex programme developed by Pay.UK, ‘the recognised operator and standards body for the UK’s retail interbank payment systems’, to improve the payments infrastructure to support interbank payments. The NPA looks to replace the UK’s Faster Payments and Bacs systems to fit the new demands and dynamics of the payments landscape.

The main driver of the NPA project is the UK’s outdated, very complex payments environment and the challenges it creates. The disruption of the pandemic accelerated the rise of alternative digital payments, with cash and cards losing their market shares to new entrants. The current payments architecture isn’t able to support the changing demands of consumers, businesses and regulators. With so many new entrants in the payments space, a complete reimagining of the ways we clear and settle payments between banks was seen as the only solution.

Leading the project is the UK’s retailer payments authority Pay.UK. Their purpose is ‘to power payments, champion innovation and give the UK choice in how it pays’ and they are responsible for running the UK’s retail payments operations, which includes the Bacs and Faster Payment, and the Image Clearing System. To learn more about Pay.UK click here.

The development of a new payments architecture is to create an agile environment that will serve the needs of banking operators, businesses and consumers today. It should also provide a solid foundation for future developments in this ever-evolving space.

The main objectives of the NPA are based on the Payments Strategy Forum 2017 vision, which is to:

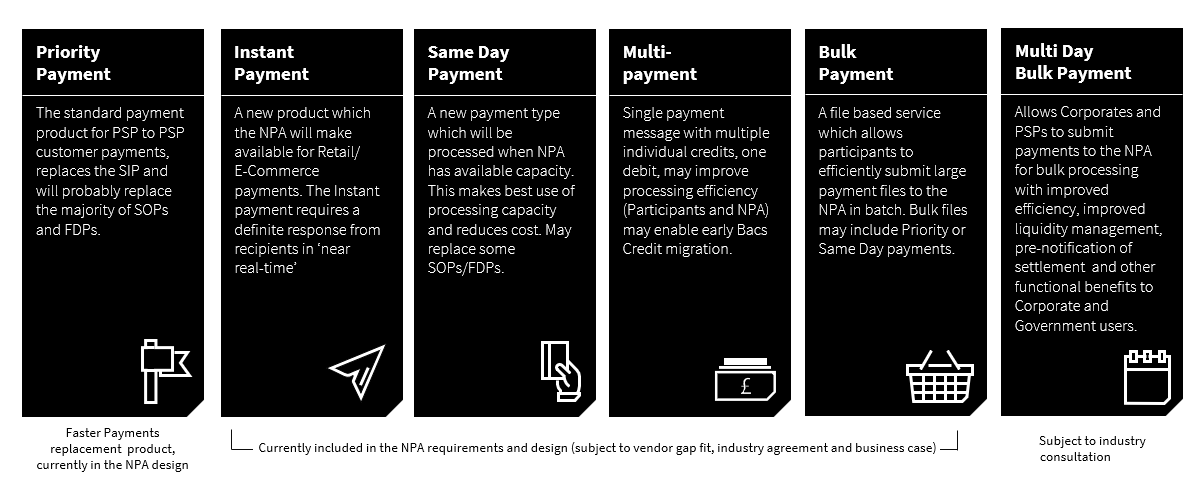

The NPA plans to support a variety of payments, which the market can utilise to create new services and innovative products. As explained by Pay.UK, the supported payments include:

Pay.UK was set up in 2017 as the New Payment System Operator but launched as Pay.UK in 2018 when the NPA programme kicked off in earnest. There is no definite deadline for the whole project, which is a large, complex, multi-year programme. Transitioning all parties from the Bacs and Faster Payments systems to the NPA is expected to start around 2025. It is estimated that by 2030 NPA will be fully up and running.

The NPA is meant to bring payments flexibility to UK merchants and their customers. Consumers should have greater choice as to how they pay, which should improve conversion rates at checkout, and reduce levels of social exclusion. The new payment methods that the NPA makes available will allow businesses to find alternative methods that work for them and their markets, introducing greater competition that should help reduce processing costs, and more innovative payment experiences to boost customer satisfaction.

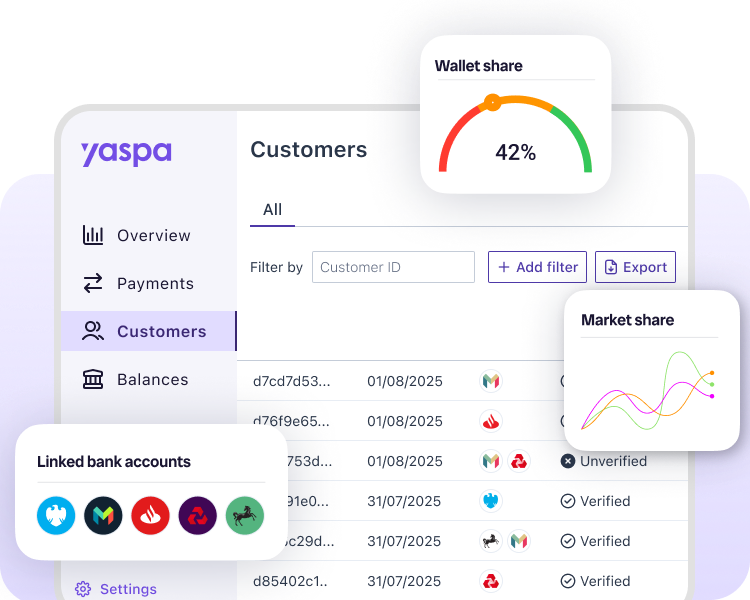

Yaspa is already one of these new(ish) innovators, offering an alternative payment method to cash and bank cards that we believe is a significant improvement for both businesses and consumers. We use open banking standards to connect to all UK banks, ensuring that anyone who has online banking can use us to pay, simply and immediately (and more smoothly than transferring money from their bank directly) (try us and see!).

Since the NPA is still in its planning and consultation stage, we can only assume how it will eventually affect open banking-based services. Open banking account-to-account payments, which run through the banks’ current APIs, will not be affected immediately or on a critical scale. The speed of A2A payments is already significantly high, the processing fees and fraud rates very low and it seems that the NPA will be more about addressing the underlying principles and foundation of the payments infrastructure. Still, even though it may not have a visible impact on open banking services, we believe its effect will be beneficial for the long run – providing a long-needed solid foundation for more innovation and less fraud in payments.

But you don’t need to wait years to see what the future of payments looks like. It’s here now. Contact Yaspa for a demo, or just to have a chat. We’d love to hear from you and answer any questions you might have about open banking, the NPA, and all things in between.

Subscribe

Discover the latest payments news and events from Yaspa and the fintech world in our monthly newsletter.

"*" indicates required fields