Subscribe

Stay in the know

Discover the latest payments news and events from Yaspa and the fintech world in our monthly newsletter.

For seven years electronic payments and banking in Europe and the UK have been governed by the 2nd Payment Services Directive (PSD2). Implemented before the mainstream take-up of account-to-account (A2A) payments (like Yaspa’s instant cardless payments), crypto payments, Buy Now Pay Later (BNPL), and digital wallets, it’s long overdue for a refresh. So, the European Commission is now revising the Payment Services Directive, which will become known as Payment Services Directive 3 (PSD3). It is expected to pass by mid to late 2023 and be implemented for eCommerce merchants, fintechs and financial institutions by 2026.

Like its predecessor, PSD3 will regulate electronic payments to boost consumer protection and trust in open banking and digital payments. Primarily aimed at those doing business within the European single market area (EEA), but also simplifying cross-border transactions, those operating in Europe and the UK will be first to be impacted. However, other countries like Brazil and Canada are also implementing open banking APIs, so implementing open banking solutions to do business in Europe and the UK can also increase a merchant’s opportunities to expand globally.

PSD3 will also regulate new financial services and products that emerged post-PSD2 such as BNPL, contactless payments, and digital wallets. It will address transparency in cross-border payments and fees, alongside addressing current concerns around Account Information Service Providers (AISPs) and Payment Initiation Service Providers (PISPs). Because these services will be more regulated, there’ll be greater public trust in their security and credibility. Consumers should feel more confident exploring alternative payment and credit options that are now regulated under the Directive.

PSD3 will also facilitate greater sharing of customer data among competent authorities, banks, tax authorities, and payment processors, making the industry more interconnected and customer-centric. It’s going to make it easier for customers to access and manage their data across platforms, and get more accurate credit scores — perhaps with faster approvals for credit products. We’ll likely see advances in services built on consumer financial data, like financial planning and budget chatbots or consolidated savings and investment apps.

In addition to PSD3, the European Commission will introduce a new Payment Services Regulation (PSR) which will ensure consumers can, “continue to safely and securely make electronic payments and transactions in the EU, domestically or cross-border.” In addition to this, it aims to provide a greater choice of payment service providers (PSPs) on the market.

Therein lies a significant opportunity for eCommerce businesses today. The range of payment options at consumers’ fingertips is about to increase, along with increased confidence in those payment services. Merchants who don’t offer a range of payment options will soon be left behind.

Indeed, if you look back at the benefits of PSD2 when it was first introduced, you can predict the scale of the changes ahead with PSD3 and the PSR. All this legislation is primarily aimed at consumers, giving them greater rights to share financial data and make digital payments with the peace of mind that their transactions and data are secure and protected against fraud. PSD2 was the catalyst for many advances in open banking that we use today including financial coaching chatbots, A2A payments, and account aggregators.

So it’s an exciting time to work with digital payments, with many opportunities to deliver a more seamless and secure customer experience.

Still, some legwork must be done to understand how PSD3 will impact your business. Tighter Strong Customer Authentication (SCA) measures are undoubtedly in the new Directive. Preparing for these now will give you a head start before the 2026 implementation date. (Happily, account-to-account payment methods such as Yaspa’s are structured in a way that avoids all the extra authentication challenges that come with cards, while still being covered by bank-grade security, and an exceptional user experience (UX) interface.)

Ideally, you’d have one or two team members scanning the horizon for any developments with PSD3, plus new technologies that will help you meet the new requirements.

Under the new Directive, consumers will feel more empowered to manage their financial data and ‘shop around’ for the most seamless payment and banking experiences. Amid this, consider how your business can differentiate itself through tailored services, innovations, and boosting customer experiences.

Because PSD3 will increase the options for consumers, their expectations are going to increase. Access to alternative payment methods like open banking will no longer be a nice-to-have for customers, but an expectation, as consumers demand interconnected services that offer a better user experience than traditional payment methods, like cards.

To remain competitive, PSPs such as payment gateways will have to stay abreast of developments (sign-up to our mailing list to receive the latest updates direct to your inbox) to better meet end-consumer expectations by offering their customers (often merchants) alternative payment methods to implement at checkout, such as A2A payments backed by open banking. To do this, partnering with a broad range of compliant and forward-looking payment operators is imperative.

PSD3 will streamline financial payments and cross-border transactions, creating new opportunities for businesses. Take time now to explore what this means for your organisation, whether that’s an expanded customer base across Europe or the opportunity to partner with other vendors.

Furthermore, countries like Brazil and Canada are following Europe’s and the UK’s lead in developing open banking APIs and legislation, potentially opening up global market opportunities. By simply integrating with the right payments provider, your business could be poised to take – and make – payments to and from an increasingly global consumer base.

PSD3 is a crucial step in digital innovation within finance. It enhances competitiveness, promotes greater consumer protections, and builds on what the industry has achieved during PSD2 to make the digital finance experience increasingly seamless and trusted.

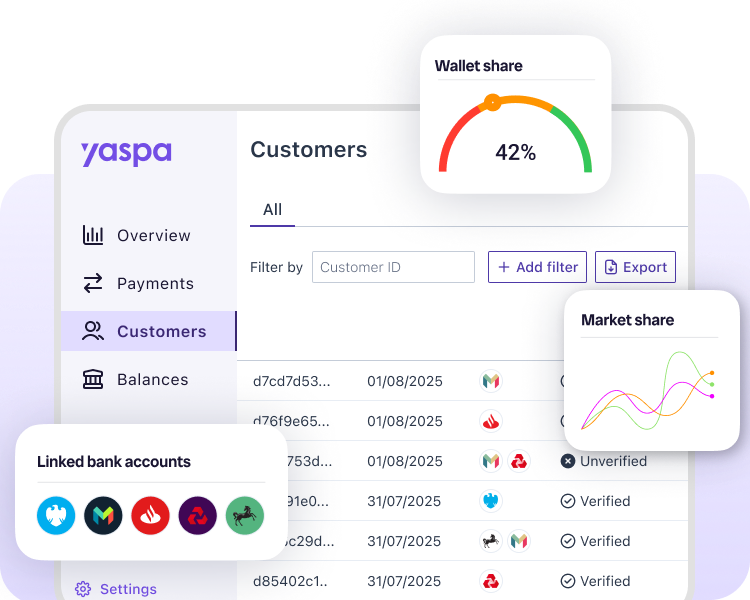

Whether you are an eCommerce merchant selling directly to consumers, or a PSP with merchant customers, with Yaspa, businesses can streamline payments to keep up with changing consumer expectations and the enhanced customer experience expected via PSD3. Instant cardless payments enable direct and immediate fund transfers from businesses to consumers, and back again, ensuring instant settlement and a user-friendly experience is accessible to anyone with online banking, while making reconciliation easy and transparent.

Yaspa’s payment solution is more cost effective than traditional methods like cards, it mitigates the risk of fraud and chargebacks, and makes paying online a lot more intuitive – and thanks to our laser focus on UX, a delight to use for any demographic. It’s the ideal solution for the post-PSD3 future.

We can expect a number of associated payments consultations during the rest of 2023 – so stay tuned and follow us on LinkedIn for the latest announcements. And to future-proof your checkout and start upgrading your payments processes, contact Yaspa today.

Subscribe

Discover the latest payments news and events from Yaspa and the fintech world in our monthly newsletter.

"*" indicates required fields