Subscribe

Stay in the know

Discover the latest payments news and events from Yaspa and the fintech world in our monthly newsletter.

Electronic Point of Sale (ePOS) and payment gateways have undergone huge change over the last few years, with the pandemic making cash-free transactions desirable – if not imperative – across a multitude of industries. The simultaneous expansion of payment solutions using open banking technology has exploded the range of electronic payment options for consumers, and we’re now seeing increased take-up of payment methods that rely on neither cash nor their default (but expensive) alternative, cards.

In this blog post, we’ll discuss the benefits of cardless payments for ePOS and payment gateway providers, their merchant customers, and ultimately the end consumer, and how Yaspa is helping these businesses to optimise their payment processes and provide an exceptional customer experience.

Cards (whether physical or in e-wallets) are the dominant payment preference of consumers (Statista, 2023), but they come with critical, though often overlooked, issues. At Yaspa we call them the three Fs: Friction, Fraud and Fees.

Online retailers usually make the user experience a priority on their website, but can find the checkout process a challenge. Payments might not be in the top five priorities for a retailer when it comes to creating a premium consumer experience, but the right point-of-sale solution can skyrocket your checkout conversion rates. One of our merchant partners observed that 30% more of their customers chose to pay with Yaspa over Stripe and PayPal when offered the choice of cardless payments at checkout. A frictionless payment option means that the end consumer goes through the checkout process much faster than they do when using debit or credit cards thanks to no pins, no card codes, and no expiration dates – and you can wave goodbye to rekeying errors.

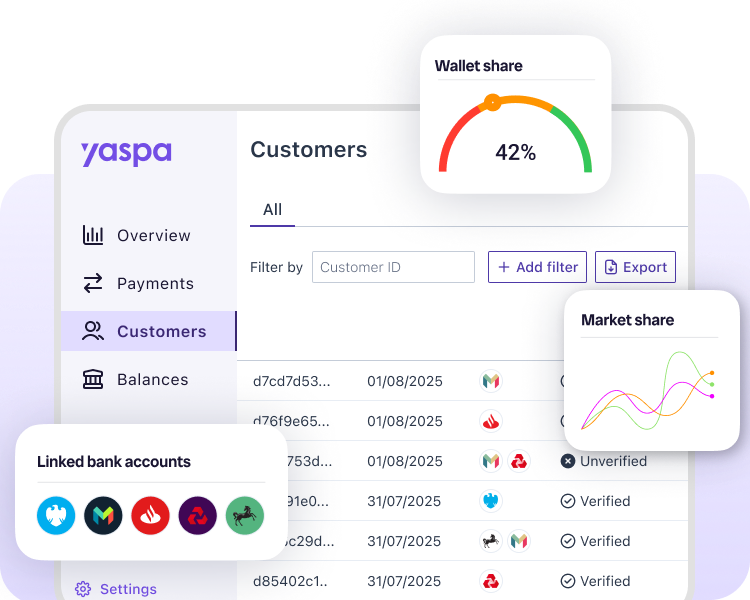

The data retrieved when an online card payment is made is often exposed to fraudulent activity when it is stored on a terminal. It can often take a while for a consumer to realise a data breach has occurred and it is usually the retailer that is left to face the consequences. Yaspa’s payments are based on open banking technology, removing intermediaries such as card acquirers from the process of transferring funds from a consumer’s bank account to a merchant’s account, and vice versa.

These account-to-account (A2A) payments aren’t a new method – in the UK we’ve been making such transfers for years. However, open banking is revolutionising how they work – because unlike transfers which rely on cards or BACS, the security in open banking-backed payments sits within the consumer’s own bank app and often in the form of biometric verification, so is as secure as the bank itself. Built-in Secure Customer Authorisation (SCA) ensures the consumer is who they say they are, reducing card-based fraud and even instances of “friendly fraud” (where perhaps a family member or child uses a card without consent). This protects both the end-consumer and the retailer.

Learn more about A2A payments and their benefits for customers and businesses alike in Yaspa’s instant guide to account-to-account payments ->

Besides the costs of handling fraudulent transactions, and the corresponding chargeback risk, the sheer number of intermediaries involved in a card payment means payment fees are invariably on the high side. Card processing fees can be as high as 6%, depending on the card issuer – a fee typically absorbed by the retailer (though sometimes shared with the shopper). To give a bit of perspective, if you take about £1M annually from sales through card payments, your merchant customers can pay up to £60,000 just in card fees. Cardless account-to-account payments remove these costly intermediaries which means they have the lowest fees in the market, often less than 1%.

Yaspa’s instant cardless payments use open banking technology to reduce friction at checkout, processing payments 36-times faster than cards to offer a seamless checkout experience. Not only does this mean that our account-to-account payments are more cost-effective, but they’re also UX optimised to make payment journeys intuitive, easy and drive conversion. It takes consumers just three steps to complete a payment with Yaspa – and funds settle instantly.

Our end-to-end solution is ready when your customers are, whether they’re merchant customers or end-consumers. You can add Yaspa as a payment option at checkout directly, or add it to your arsenal of payment options on offer to merchants alongside your existing providers. We work with many brands, large and small, across the UK and Europe, including payment gateways and e-wallets from a variety of sectors, and we’d love you to try it.

Try Yaspa’s payments for yourself by making a £1 charitable donation to Shelter Yaspa, and for a full demo or to talk to us about adding Yaspa to your checkout, contact us Yaspa.

This article is a revision of one published in February 2022.

Subscribe

Discover the latest payments news and events from Yaspa and the fintech world in our monthly newsletter.

"*" indicates required fields