Subscribe

Stay in the know

Discover the latest payments news and events from Yaspa and the fintech world in our monthly newsletter.

Open banking initiatives have revolutionised the financial services landscape, enabling companies to innovate in areas like payment methods, personal finance management, and customer identification. In this article, we’ll explore some of the main approaches that businesses can take to leverage the benefits of open banking.

However, before we dive straight into it, open banking can be a complex field with its own set of terms and acronyms. To help you navigate this world, here’s a concise glossary of essential terms:

For organisations looking for open banking solutions, there are three typical approaches when it comes open banking integration:

Creating your own integration is a significant effort and is most suitable for businesses planning to build products or services entirely based on open banking. However, even in this scenario, working with an API aggregator may offer advantages.

For businesses choosing this path, becoming regulated as an open banking provider and developing API connections with each bank is necessary.

The regulatory process involves assigning compliance teams or hiring legal assistance, along with developers for API integration. Ongoing efforts are also required to maintain these API connections.

User experience is crucial, and investment in creating an intuitive interface is essential. Building an integration is resource-intensive, but it provides complete control over open banking technology.

API aggregators provide businesses access to multiple bank APIs through a single interface. This approach streamlines the process compared to manual integration with each bank.

Working with an aggregator allows you to start with open banking more quickly than building your integration. However, product development is still necessary since API aggregators are not “plug and play” services.

Depending on the regulatory status of the API aggregator and your specific use case, you may need to be regulated as a PISP or AISP. Not all aggregators are regulated, but it’s crucial to clarify this early in the process.

Aggregator services typically involve volume-based pricing and may include integration fees. While it’s cost-effective compared to building your integration, it still requires some development effort.

End-to-end solutions allow you to harness open banking without extensive development work. These solutions are designed to be readily integrated and used by organisations.

An ideal end-to-end solution should offer a user-friendly experience and an intuitive interface. While it may not cover all niche use cases, it’s suitable for common ones.

Cost estimation for an end-to-end solution is straightforward. You pay for the product or service, with pricing models varying. Integration may also involve fees.

The time to market is short, as there’s no need for in-depth technology development. Consider factors like supported countries and banks, onboarding ease, data security measures, and the end-user experience when evaluating a service.

Once you’ve defined your open banking goals, it’s time to select the approach that suits your needs:

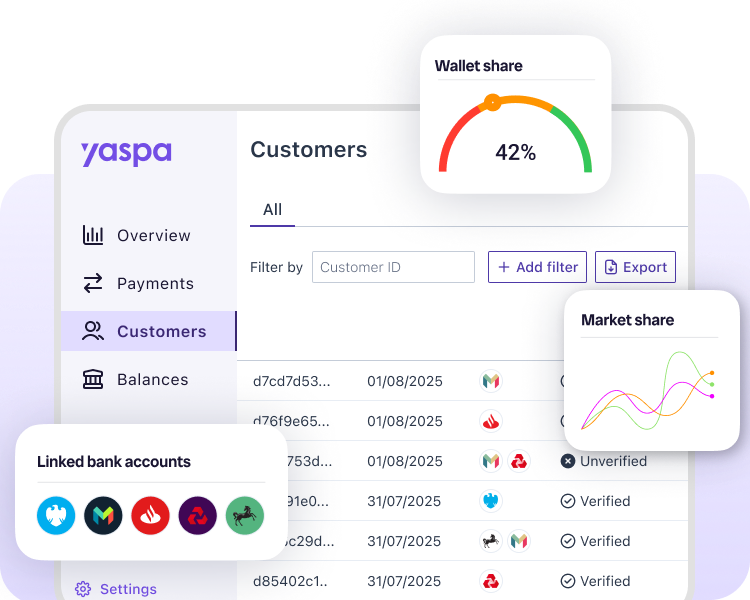

Yaspa is an intuitive open banking platform which enables quick, cardless account-to-account payments. As Yaspa is an end-to-end solution, there’s no extensive development work and integrates directly into your existing systems, making getting started easy with no downtime. We’re obsessed about user experience (UX), in fact, it’s one of our core USPs, meaning we provide all of our customers with a seamless user experience and an intuitive interface. As for banking coverage, we’re connected with over 1200 banks across the UK and Europe. Why not get in contact with us and find out how Yaspa can benefit your business today.

This article is a revision of one published in August 2020.

Subscribe

Discover the latest payments news and events from Yaspa and the fintech world in our monthly newsletter.

"*" indicates required fields